How to calculate it and why is it important

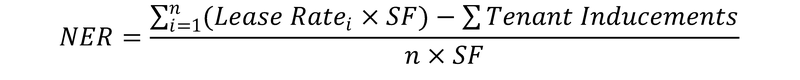

Net Effective Rent ("NER") is a calculation done to determine what rent is being offered to a landlord net of all other costs and as a dollars per square foot ("PSF") number. It is calculated by taking the total rent paid over the term of a lease and deducting all inducements being asked by the tenant. This number is then divided by the term and the size of the unit to arrive at the NER. Mathematically it is represented by the following formula:

Where:

- Lease Rate = Rental Amount, in dollars per square foot

- i = represents the year being calculated, beginning at year 1

- n = the Term of the Lease, in years

- SF = the Size of the Leased Premises, in square feet

So what does this number represent and why is it important? Regularly we are asked from tenants if a landlord is willing to accept a certain PSF rental number. As an example, if the asking lease rate is $25 PSF, will the landlord be willing to accept $20 PSF? Seems like a simple enough question, what's the difference from asking a seller if they are willing to accept a lower price?

The reason is because a purchase -- be it a house, land, electronics, or that necklace you bought from a street vendor in Mexico -- is a one time payment made on a certain date. Prior to that date, the item is the seller's responsibility; after that date, it becomes the buyer's. The transaction is concluded once the money is transferred and there really isn't - generally speaking - any financial implications other than the price. So asking if a vendor will accept a certain price is easy to answer because it really is the only factor.

A lease by contrast is a series of cash inflows and outflows over a period of time. The cash inflows represent the rental payments, typically paid in monthly installments. The cash outflows represent costs incurred or paid out for various items. Outflows can also be the non-payment of an inflow. Let's expand the above example:

The tenant only wants to enter into a three year term and pay $20 PSF for the entire term. Let's assume that the size of the unit is 1,200 SF. That means that the annual rental payment is $24,000 (20 x 1200). On a three year term, that means the tenant will pay $72,000 total. This is the first part of the above equation. Now, in addition, the 1,200 SF space needs some fixing up so the tenant also would like a $30 PSF tenant improvement allowance and, since they are starting out, six months of free rent. The $30 PSF is $36,000 in costs and the six months of free rent equals $12,000 in foregone rent. The total of these two amounts equal $48,000. These are tenant inducements and is the second part of the equation. To finish the equation, $72,000 less $48,000 equals $24,000, which divided by three years and 1,200 SF, equals $6.67 PSF.

Therefore the NER ends up being $6.67 PSF and this is the net amount that the landlord will receive over the term of the lease. That number is well below what would be considered market value and even though the tenant is offering $20 PSF, the real amount that the landlord receives is considerably lower. When you take into account when those amounts actually occur, it becomes even less attractive because the tenant improvement allowance is paid at the start of the lease and the free rent happens during the first six months. It won't be until the start of year 3 that the landlord has broke even! That is also assuming that the rental amounts are paid and no unfortunate incidents happen from now until the end of the term where the tenant may not be able to make those rental payments (since they start paying rent in month 7). Most individuals would probably look at that math and come to the conclusion that the offer on hand isn't worth it. It's also not uncommon to receive an offer where the NER ends up being negative!

As you can see, the rental rate is only one part of the equation to determine whether a lease offer makes sense. You really need to evaluate the entirety of the offer before you can answer yes, I will accept $20 PSF. Obviously the deal needs to makes sense to both parties but if you can see where the landlord is coming from, a tenant may find that the landlord is willing to negotiate more fairly when the NER is closer to what they expect for their property.